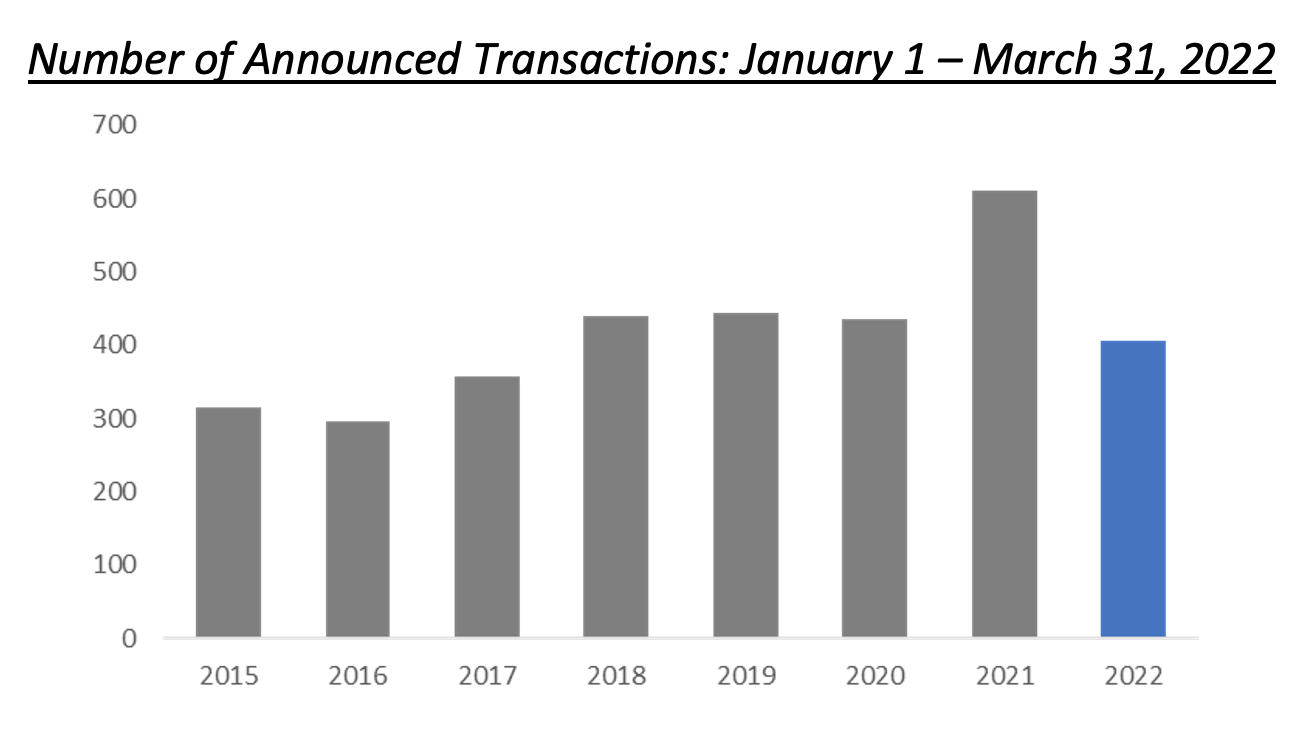

At first glance, Q1 2022 was a challenging quarter for Canadian M&A. Between January 1 and March 31, 406 transactions were announced, representing a 34% decrease compared to Q1 2021 and the lowest Q1 deal volume since 2018.* Understandably, some business owners who were contemplating potential M&A strategies are wondering if they have missed their window of opportunity.

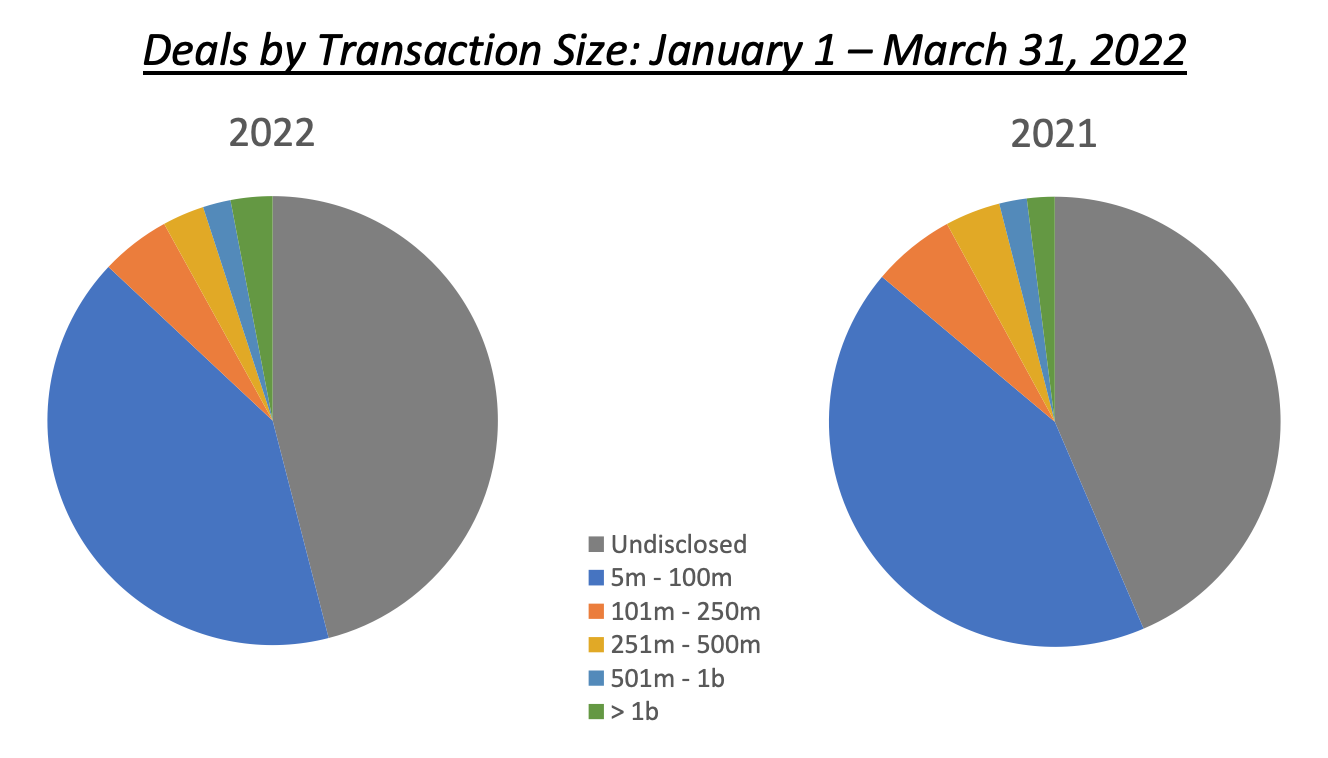

Fortunately, the context behind this data is more encouraging. The slowdown in Q1 2022 versus Q1 2021 was largely expected, due to last year’s record deal volume. Much of the Q1 2021 activity resulted from a backlog of transactions that were delayed due to the COVID-19 pandemic. Furthermore, the middle market continues to make up a vast share of overall deal activity, with most transactions with disclosed values during Q1 2022 between $5 – $100 million.**

*Source: FP Advisor, accessed June 29, 2022.

**Source: Ibid.